Research and Benchmarking

- Home

- |

- Research and Benchmarking

Creating new insight with proprietary research into fund board effectiveness and development, and providing bespoke benchmarking, is core to supporting our corporate members and clients, and driving forward understanding and knowledge in good practices across the industry.

Our fund board effectiveness and development insights and benchmarking programme spans a number of key areas including:

Fund Board Composition

Fund Boards Council has analysed data covering the boards of over 80 UK authorised fund managers, which includes almost 500 board directors, of which over 200 are non-executive, to develop the FBC Board Composition Database.

Fund Board Effectiveness

The FBC fund board effectiveness barometer is a series of in-depth surveys and focus groups designed to provide a valuable source of peer insight into the key aspects of fund board effectiveness.

Independent Director

Remuneration

Fund Boards Council now offers a service for asset management firms looking to ensure that they have competitive remuneration arrangements in place for the independent directors on their fund board.

Fund Board Composition

Governance Guardians: UK ACD board directors

Largely invisible until 2019, board directors on UK authorised fund managers (AFMs) have a clear and important role in protecting investor interests for over £1.5 trillion in UK mutual fund assets

Since the implementation of the Financial Conduct Authority’s (FCA) Asset Management Market Study (AMMS) in 2019, FBC has examined the evolution of AFM’s ‘fund boards’, and, from 2022, developed a proprietary database providing insight into the composition of these boards. Largely for internal use to support FBC’s board governance and effectiveness work and FBC members in the assessment of their own fund board composition, the analysis is updated annually and is now in its second iteration.

Download the FBC Database

Download the November 2022 edition.

Updated statistics are available exclusively to FBC corporate members. Please get in touch at contact@fundboards.org to request the most up to date information.

FBC evaluated over 80 ACD boards made up of some 500 directors in total, about 40% of whom are non-executive directors. The FCA requirement is that every fund board in the UK must have a minimum of two non-executives on their boards, or account for a quarter of the directors on the board. The current average stands at just under 2.5 non-executive directors per board, with an average of 6 directors (non-executive and executive) on every board.

On average, executive directors make up the majority of the fund board, and the FBC insight includes extensive details on functional responsibilities as well as seniority, in addition to details of those who have additional governance responsibilities, such being the CEO of fund board with the Senior Manager Function (SMF) 1 responsibility.

FBC’s analysis of this data over the last couple of years has thrown up some interesting trends and themes. These include:

- The growing proportion of board chairs moving from executive to non-executive roles

- The quite small number of non-execs who sit on more than one fund board in the UK

- The quite (relatively) high turnover of board directors’ year-on-year

These trends and others were discussed at an FBC online webinar, ‘Fund Board Composition – Evolution, impact and regulatory requirements’, on the 6th of February 2024.

Following the meeting, FBC corporate members have exclusive access to:

- the recording of the ‘Fund Board Composition – Evolution, impact and regulatory requirements’ on the 6th of February 2024

- A custom analysis of their own fund board composition versus the whole of market

- Benchmarking of their own fund board composition against a group of peer boards

- A bespoke presentation and discussion of industry trends

FBC Fund board effectiveness barometer

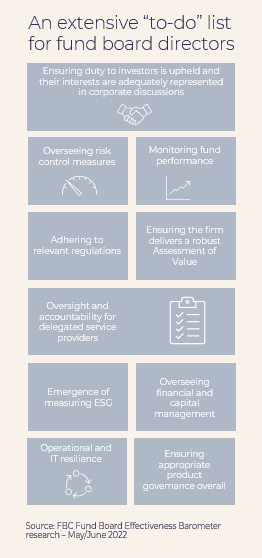

The FBC fund board effectiveness barometer is a series of in-depth surveys and focus groups designed to provide a valuable source of peer insight into the key aspects of fund board effectiveness. Over the course of the year, we will be examining topics including Fund Board Purpose, Culture and Behaviours, Structure and Composition, Board Process and Assurance and Monitoring.

These surveys will canvass views from executive and independent directors in the UK and across Europe, drawing on their experiences at the sharp end of fund board governance to explore examples of good practice in the industry. The survey results, ‘the barometer’, and accompanying analysis, will be available to FBC corporate members in a series of member meetings and detailed reports, as part of the corporate membership of FBC.

Contact us for more information about FBC’s research.

The FBC Report: Fund Board Purpose

The Evolving Role of the Fund Board

At the start of 2022, Fund Boards Council (FBC) convened a group of fund board directors as part of our Fund Board Effectiveness programme. The discussion quickly turned to the role and purpose of the fund board, the increasingly wide-ranging areas its directors are overseeing and how well understood its remit is elsewhere in asset management firms.

There was some concern that the fund board’s overall role and purpose is not always as clearly understood within the wider firm as it should be, particularly given the regulator’s very clear view on the ‘primacy’ of the fund board. Moreover, this lack of understanding or lower levels of engagement with the board is impacting on directors in a variety of ways as they discharge their governance duties.

The FBC Fund Board Effectiveness Barometer questioned fund board directors across FBC’s corporate member firms and this was followed by an FBC members meeting, providing additional insights and examples of good practice included in this report. The full report also includes a framework of questions for fund boards to consider in the context of their own governance aims and priorities.

Download the excerpts of the FBC Report: Fund Board Purpose

If you are interested in finding out more about FBC’s work on Fund Board Purpose, please get in touch at contact@fundboards.org

Excerpts of the report are available, and the full report is available for FBC members in the Member Portal.

Membership

Explore our content

The benefits we offer to our Corporate Members

Gain ValuABLE PERSPECTIVES

Benefits of FBC membership

Access to Highly relevant perspectives

Why join?

Membership, Consultancy, Training and iNED Services for Fund Boards