Fund Governance: So why are we here and what are we doing?

A number of incidents in the recent past has got me thinking about governance. The first was Stuart Kirk’s typically contrary piece in the FT about the proven uselessness of governance as a driver of economic success.

Then I was in a discussion at the board of a charity I founded 40 years ago. It has grown like Topsy, is brilliantly successful, 54 City Academies, numerous community Hubs, great work with homeless and with damaged youth. And we were discussing whether and how to develop some central messaging. On the board is an experienced ex-IBM executive so I asked her how they used to handle this issue. She said they had numerous rows but always, at the end, the mantra was: Customer first, IBM second, me/locals third. I am sure it never ran perfectly like that, but it stuck in my mind.

And my memory went back some years now to a discussion Howard Davies, then Chair of the FSA, had with a firm of US advisers who had set up in the UK. He asked them what they would do differently if there was no FSA regulation. They said “nothing”.

Fund Boards Council is committed to good governance, and it is a driving belief behind the FCA’s programme. So, does it matter and if so, how?

The different answers from Stuart Kirk and IBM give us a clue. Stuart is primarily interested in return to investors, governance doesn’t really matter so long as the company is well run economically.

But an iNED in an ACD or unit trust company has a different focus, the customer’s well-being. That can lead to problems as the parent company will also have an eye on Stuart’s idea of success.

Which leads to the Howard Davies story. Are we doing what we do as directors because the regulator tells us to, or because it is the right thing to do? And how does that attitude permeate through the culture of the company? There is a problem, I believe, in that the FCA judges governance by process rather than outcome, so there is focus on board minutes, reporting and form filling rather than customer outcome. Good process is a necessary but not sufficient condition for good governance. And the FCA’s view of how the process should work is painfully costly for firms and therefore, in the long run, for investors.

Could we persuade them to judge firms and regulatory intervention on outcomes at least as much as adherence to process?

In the meantime, are we judging board decisions by what is good for the customer rather than just because the regulator told us to do it?

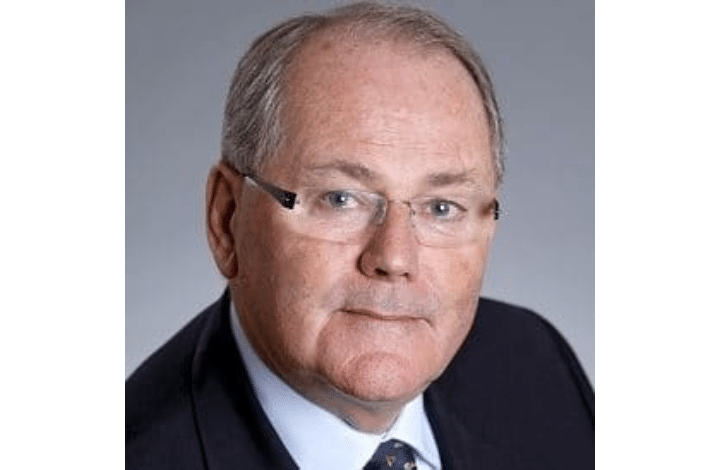

Having spent over 40 years in financial services and asset management and a keen observer of regulatory and governance trends in the UK and across Europe, not much escapes Philip’s watchful, and sometimes critical, eye. Amongst his various roles, Philip chairs FBC’s advisory council, but, as always, the views and opinions in his columns are his own.