FEATURES & ANALYSIS

Discussion on the FCA’s Sustainability Disclosure Requirements consultation

Hot on the heels of the publication of the FCA’s Sustainability Disclosure Requirements consultation (CP22/20), FCA Technical Adviser Mark Manning presented and took questions at an exclusive FBC corporate member discussion.

Delving into some of the burning questions on this new requirement, Mark was joined by Sandra Carlisle, Head of Sustainability at Jupiter, Julie Patterson, iNED, charity trustee, regulatory consultant, and chair of the Investment Association’s Sectors Committee, and FBC senior adviser Brandon Horwitz hosted.

Read the write up here. FBC corporate members can also view the full recording of the meeting and Mark’s presentation here.

Consumer Duty Musings, from a lower league football fan

FBC senior adviser, Simon Hynes, explores the implications for fund boards as firms implement their plans in line with the requirements of the Consumer Duty. Simon deliberates through Assessment of Value and adviser fees, to data challenges and considerations over what can/can’t be obtained, and the seeming advantages of vertically integrated firms. Read the article here.

FBC AGENDA 2023

As we rapidly approach 2023, the FBC team has been hard at work shaping up our agenda for FBC corporate members in the coming year. Along with a range of corporate member meetings, in-person and digital and with regular FCA representation, we will also be building on our strong portfolio of reports. Look out for our emails early in 2023 to participate in our research on Assessment of Value – Three Years On, and Service Provider Oversight, with the opportunity to receive bespoke reports for corporate member participants.

To view the FBC Summary Agenda 2023, click here.

Letter from America

Theresa Hamacher, president of Versanture Consulting, and chair of the Morningstar Funds Trust board in the US, provides us with her unique insights as an American fund director in London. Looking at the overall outlook, ESG, other regulation, and fees and costs, Theresa explores the ‘parallel paths.’

Read the article here.

SPOTLIGHT

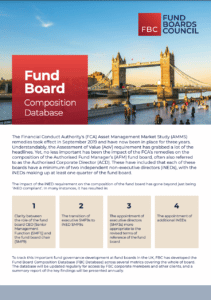

UK Fund Board Composition

With unique insights such as gender split and director numbers, FBC has launched the FBC Board Composition Database (FBC Database). The analysis includes data from the boards of over 80 UK authorised fund managers, which includes almost 500 board directors, of which over 200 are non-executive. Read the insights from the first iteration of the FBC Database here.

Sustainable Investment Fund Oversight Review

Does your fund board have confidence that your funds are ‘doing what it says on the tin’ when it comes to sustainability and Environmental, Social and Governance (ESG) objectives?

You might want to consider getting some independent assurance from FBC’s new Sustainable Investment Fund Oversight Review (SIFOR) to identify any areas requiring attention.

FBC MD Catherine Battershill and FBC senior adviser Brandon Horwitz provide the lowdown on how this could help your fund board here.

CROSS BORDER INSIGHTS

Letter from LUX

Sheenagh Gordon-Hart, portfolio iNED and partner in The Directors’ Office, provides the latest on doing business in the established fund domicile of Luxembourg, with focus on the cost-of-living crisis and the EU’s agenda on spending.

Read the article here.

Aldcroft on Asia Pac

This quarter Stewart Aldcroft, long time Hong Kong resident, veteran of the Asian asset management industry and FBC Advisory Council member, looks at whether Hong Kong is truly back to business after almost three years of lockdowns and disruptions caused by covid.

Read the article here.

PROFILE

Invesco’s Head of EMEA Corporate Governance and Company Secretarial, Andrea Davidson, speaks to FBC CEO Shiv Taneja.

Andrea discusses the impact of regulatory changes and the governance that’s come into play in the UK and continental Europe, as well as board composition and her personal ‘bugbear’ the next generation of talent.

To watch the interview, click here.

FBC IN THE COMMUNITY

We are very pleased to have raised over £880 which will be split among our chosen charities, HomeStart CHAMS, Ambitious About Autism and Winston’s Wish.

For more information on FBC’s charity support click here.

BOARD BUSINESS

Top reads

The FCA portfolio letter, Patricia Dunne’s speech and the SEC pointing out fund board failings were the most read items from our blog last week. In case you need to catch up with the crowd, here are the relevant excerpts:

Expectation and consultation

Financial Conduct Authority (FCA) has published its portfolio letter for financial advisers and intermediaries, here. Key themes include suitable advice, pension and investment scams, firm failures/phoenixing and ongoing services, along with others such as diversity and inclusion. It has also announced new proposals to make it cheaper and easier for firms to advise consumers about certain mainstream investments within stocks and shares ISAs. Read more about the consultation in the press release here.

Concentrating on CP86

Speaking at a PWC event, Director of Securities and Markets Supervision at the Central Bank of Ireland, Patricia Dunne, previewed the results of the latest round of CP86 resourcing reviews: CEOs (where they expect that all but the smallest fund management companies have a CEO), Director time commitments (where they expect directors to be mindful of whether their commitments are sustainable), Designated Persons & Support Staff (with a focus on resources growing in line with the nature, scale and complexity of the business), INED Tenure (with fewer INEDs with a tenure of greater than ten years, and questions about the independence of those with 10+ years), Board Diversity (with marginal increase in gender balance and the expectation of diversity being considered on fund boards). Read the full remarks here.

US fund boards under fire

During its national compliance seminar earlier this month, the Securities and Exchange Commission (SEC), detailed common ways fund boards are falling short of their 15(c) contract renewal duties. Read more in Board IQ, here.

FBC Member Events & Engagements

January-March 2023

Date: 2 March 2023

FCA supervisory strategy for asset managers

For further information click here. Registration is open exclusively for FBC corporate members here.

Date: 21 March 2023

Examining the role of the independent chair

Whilst there is no current regulatory requirement for fund boards to have independent chairs, FBC’s own research and industry discussions suggest that many fund boards have either already transitioned their chairship from executive to independent or are working on a plan to do so.

Drawing on FBC’s latest proprietary research in this area, this meeting will explore the pace at which the industry is moving towards independent chairs on fund boards, the impact on board dynamics and the key considerations for firms thinking of making this move.

This digital event is open to FBC corporate members and non-members. For more information and to register, click here.